2020 has been a challenging year for the child care industry, but you can take certain steps as you close out the year to set your child care business up for success in 2021. Thanks to our friends at Gusto, we have a practical checklist to help you get started.

Reconcile

For the end of the year, it’s important to make sure your monthly financial statements reconcile (i.e., match up) to your cash and credit accounts, and that you make any adjustments as necessary. Gather and organize receipts, which will help you account for and categorize many of your expense

Review your financial statements

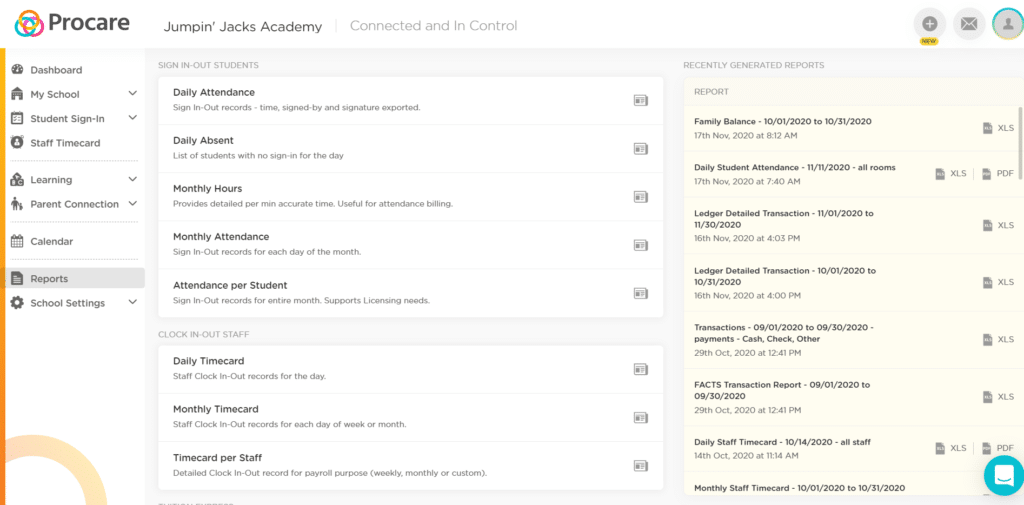

Now that everything’s reconciled, it’s time to take a hard look at financial statements like profit and loss (P&L), balance sheet, cash flow, budget variance and more. It’s a good practice to review how you’re making and spending money and the financial position of your business.

Fortunately, if you use child care management software, you can review financial statements and create reports with the click of a few buttons, ensuring you can easily obtain a clear picture of your financial situation.

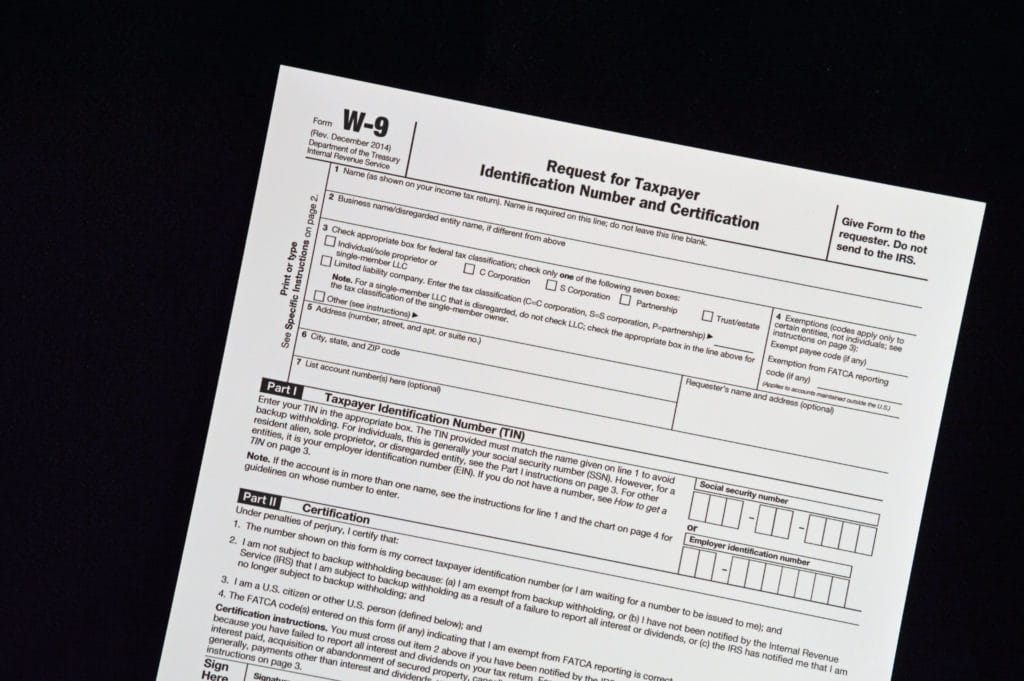

Collect W-9s and 1099s

Did you use vendors this year? If so, you’ll have to collect W-9 forms for some of them. The W-9 form can be used as a paper trail for the IRS to track your expenses. It’s also a way for the government to keep track of vendors and their income.

For every contractor you’ve paid $600 or more for services, you’re required by law to issue and complete a 1099 form. The 1099 must be filled out and sent to the IRS by January 31. Fortunately, if you have a child care management software solution, you will have a line item for all 1099 vendors and contractors. Something to note: a new form (1099-NEC) will be required for most contractor relationships instead of 1099-MISC. More information about this change here.

Check your payroll

A few common areas to watch out for are withholding taxes for fringe benefits (these are benefits employees receive in addition to their compensation, such as health flexible spending accounts, tuition assistance, employer-provided cell phone and child care reimbursement), deferred compensation and end-of-year bonuses

Accounts receivables and invoices

With everything you have going on, it can be easy to lose track of invoices and forget to collect on them. If you’re using child care management software, invoices can be sent out automatically when payment is due.

Verify employee data and benefit information

It’s important to review employee data for the end of the year, particularly with employee names, addresses and Social Security numbers. Improperly filing this could lead to penalties for each misfiled W-2. Information you should make sure you verify includes:

- Employee name

- Employee address

- Employee Social Security number.

If you’re still not certain about your employee’s Social Security number or just want to get it verified, the IRS provides employers with the Social Security Number Verification Service (SSNVS) to minimize employee name and SSN mismatches.

Verify employee benefit information

We often set and forget employee benefits. But the end of the year is an important time to verify your employee benefits information. Here are some key items to confirm or review:

- Confirm retirement plan eligibility

- Confirm health benefits, including dental and vision, (and imputed wages)

- Confirm fringe benefits

- Review sick time

- Review vacation time

- Review deferred compensation

For retirement benefits, like your 401(k), you’ll want to give advanced notice of benefits, like enrollment features and withdrawal provisions to your employees. If your company matches, your employees may want to fully fund their plan by the year-end. For more information on retirement plans for small businesses, check out the IRS’s page on retirement plans for small businesses.

For health benefits, you’ll want to confirm your employees have selected and contributed to their respective health care plans. For employees on a health Flexible Spending Account (health FSA) or a dependent care FSA (DCFSA), make sure your employees have spent the money in their health FSA or DCFSA before the end of their run-out (or the grace period), or else they’ll forfeit remaining funds in those accounts. If you’re not sure if you have a run-out period or a grace period, contact your broker or third-party administrator for those benefits.

If your health FSA or DCFSA has a $500 carryover (also called “rollover”) option, let your employee know. If you’ve offered fringe benefits to employees, you’ll want to make sure you’ve withheld taxes for any taxable benefits your employees have received throughout the year. For more information on taxable fringe benefits, check out IRS Publication 15-B. For more benefits-related content, check out SHRM’s Year-End Checklist for Retirement and Health Plan Sponsors.

Finally, be sure to confirm all sick and vacation time used by your employees. If your employee has used sick time, you’ll want to make sure it has been accounted for properly. For some companies that have a rollover, you’ll want to account for balances that are available for next year.

Make End-of-Year Financial Tasks Easy with Procare

Having a checklist can help you figure out the tasks you need to complete to make sure your business is in sound financial standing; however, completing those tasks can be cumbersome. By using Procare’s child care management solution, all the data you need for end-of-year accounting is at your fingertips. Let us help you simplify every aspect of running your business, including year-end finances – request a demo today.

For additional small business financial and payroll information, you can visit Gusto’s blog.

Procare Online customers have access to Gusto’s fully integrated payroll platform – learn more.