Let’s face it, 2020 was tough—especially for child care centers and the dedicated people who own them. While 2021 looks more promising, you may need a financial boost to ensure your business can survive this year and thrive in the ones to come.

With that in mind, let’s talk about loans and grants for child care centers. Keep reading to learn about five available financial aid options and how to decide which is best for you.

5 Loans and Grants For Child Care Centers

So what are your options when it comes to loans and grants for child care centers? There are plenty of ways to receive the capital you need. You just have to decide which ones suit your needs best. We’ve listed five options to consider below.

1. CCDBG Funds

The Child Care and Development Block Grant, also known as CCDBG Funds, provides federal funding to individual U.S. states. The goal of the grant is to help low-income families afford child care. With the recent passage of the American Rescue Plan Act of 2021, the CCDBG program will get an extra $15 billion in funding to support both families and child care providers in need.

If your business can’t make payroll or pay rent, is in need of cleaning and sanitation supplies, or otherwise struggling financially due to COVID-19, you may be eligible for CCDBG funds.

To learn more about the Child Care and Development Block Grant and whether your business qualifies for aid, contact your state’s child care office. In addition, check out the federal Office of Child Care’s website for information on capital for your business.

2. CACFP Funds

For many daycares, the cost of food is a large, ongoing expense. Fortunately, there are grants for child care centers that aim to alleviate this financial burden.

The Child and Adult Care Food Program (CACFP) provides funds to care centers like yours that can be used to purchase nutritious meals and snacks for eligible children. The way it works is by giving cash reimbursements to child care centers for serving meals and snacks that meet Federal nutritional guidelines to eligible children. In general, centers may be approved to claim reimbursement for serving up to two meals and one snack, or two snacks and one meal, per day to each child participant.

CACFP funds are managed at the state level, so check with your local agency to determine how your center can participate. More about the program here.

3. PPP Loans

Good news: the Small Business Association (SBA) recently announced that the Paycheck Protection Program (PPP) has reopened for new and (some) existing borrowers.

Be aware that there are differences between this program and the one offered in April 2020. For example, PPP loans can now cover additional expenses including business software (like Procare), property damage and worker protection.

Eligible daycares will be able to borrow up to 2.5x their average monthly payroll costs.

This begs the question, who is eligible for the PPP program this time around? If you can prove that your child care business revenue dipped by 25% in any quarter in 2020 when compared to the same quarter in 2019, you are likely eligible for a PPP loan.

For information regarding PPP loan applications and forgiveness, read this post.

4. Traditional Business Loans

The loans and grants for child care centers listed above will provide your business with working capital that you can use to grow operations and/or make ends meet during the COVID-19 pandemic. But these aren’t the only forms of aid available to you.

You can also apply for a traditional business loan. Here are a few that might interest you:

- Equipment Financing: If you need to purchase new equipment for your child care business, i.e. cribs, toys and computer systems, equipment financing may be the best option. To apply, submit a quote to your lender for the equipment you need. Then pay back the loan (plus interest) in the agreed upon amount of time.

- Term Loans: A term loan is what most people think of when they think about loans. A lender deposits a lump sum into a business’s bank account. The business then works to repay the loan (plus interest) over time. There are different kinds of term loans. The one you choose will depend on your goals. Talk to your lender for more information.

- Business Credit: If cash flow is your biggest concern, a business line of credit could do wonders for your child care center. This loan type allows business owners to draw money against a line of credit and receive funds quickly. The best part? You only pay interest on the amount of cash you draw, not the full amount you’re approved for.

5. Capital from Friends and Family

There’s another potential source of capital you can consider: your friends and family.

If your parents, siblings or friends have additional resources to support your endeavor, consider asking them for a loan. If they agree, you’ll likely receive funding at favorable terms (some family members may not even charge interest).

But be aware, money can change or even ruin relationships. If you decide to borrow funds from a family member or close friend, we suggest making the terms crystal clear and working hard to pay them back as quickly as possible. That way you’ll avoid uncomfortable scenarios.

How to Choose the Right Financial Aid Option

The right financial aid option for your child care business depends on your needs. There’s no one-size-fits-all solution. So how do you choose? Here are a few tips:

Evaluate Your Goals

What are you hoping to achieve with additional funding? Your goals will help determine the financial options available to you. For example, if you’re just trying to keep the lights on during the COVID-19 pandemic, you could be eligible for a PPP loan. But if you’re looking to expand your child care center to multiple locations, a traditional business loan might be a better fit.

Assess Your Timeframes

How quickly do you need financing? And how quickly will you be able to pay back a loan you’re given? While most grants don’t have to be repaid, they take longer to secure. Loans, on the other hand, can be acquired quickly, but you’ll need to pay back the money you borrow in the agreed upon amount of time. If you need cash now, a loan is probably your best option. Just make sure the monthly payments don’t hurt your business in the long run.

Be Honest About Your Business

Finally, ask yourself, “How much money do I really need?” You might qualify for a large loan, but is that the best thing for your business? Remember, loans aren’t free money. They must be repaid—with interest. Make sure you have a solid plan for the capital you borrow. That way the funds you acquire will be spent in a responsible way that improves your business.

Finance Your Child Care Center

If you need financial aid to start, sustain or expand your child care business, don’t worry! There are options available to you, as we outlined in this article.

The trick is deciding which option suits your needs best. Once you’ve determined that, simply apply for the loan and/or grant and use the funds to build a better business.

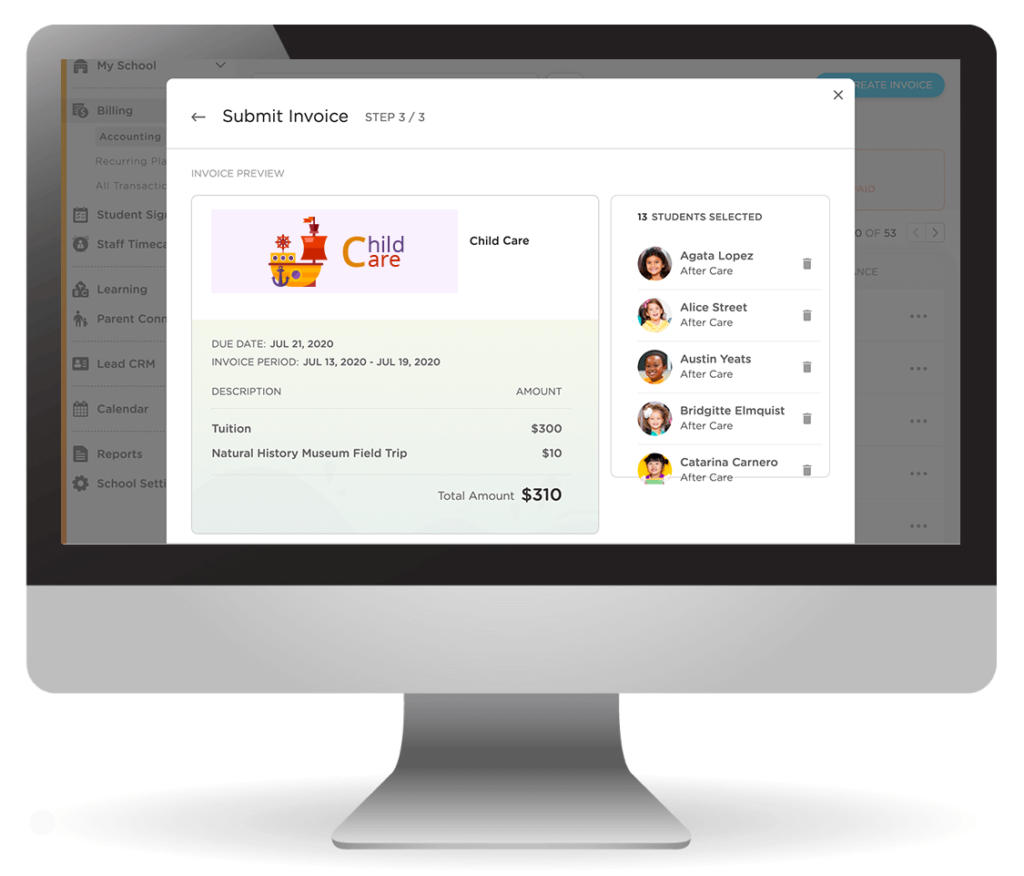

Another way to build a better child care business is to automate manual processes like student attendance tracking, enrollment and billing. Doing so will save you time and money and reduce your stress levels. Automate these processes and more with Procare, which offers modern, easy-to-use software to manage every part of your child care business. Request a free demo of our software today to see first-hand how we’ve helped simplify child care management for thousands.